Investment Solutions

Managed Accounts offered through Primerica Advisors

Primerica Advisors Lifetime Investment Program

Focused on the client’s investment needs: The Primerica Advisors Lifetime Investment Program is designed to enable advisors to assist clients in achieving goals throughout the client’s investing lifecycle. Advisors can assist clients through the accumulation, preservation and income distribution phases of their lives.

Access to professional asset managers: The program provides access to professional asset managers who have established track records in asset allocation and security selection using exchange traded funds, mutual funds, and individual stocks and bonds. Each asset manager is selected based upon the quality of their people, philosophy, process and performance.

Primerica Advisors Lifetime Investment Program

Asset managers chosen to help you solve needs across the investing cycle

learn more about us

Individuals identified as Torchlight Financial Group are affiliated with PFS Investments Inc. a subsidiary of Primerica, Inc., and offer products and services through PFS Investments Inc.

A Primerica representative’s ability to offer products and services is based on the licenses held by the individual, and the states in which the individual is registered. Not all representatives are authorized to sell all products and services. For additional information about a representative, including licenses and state registrations, please visit www.BrokerCheck.com.

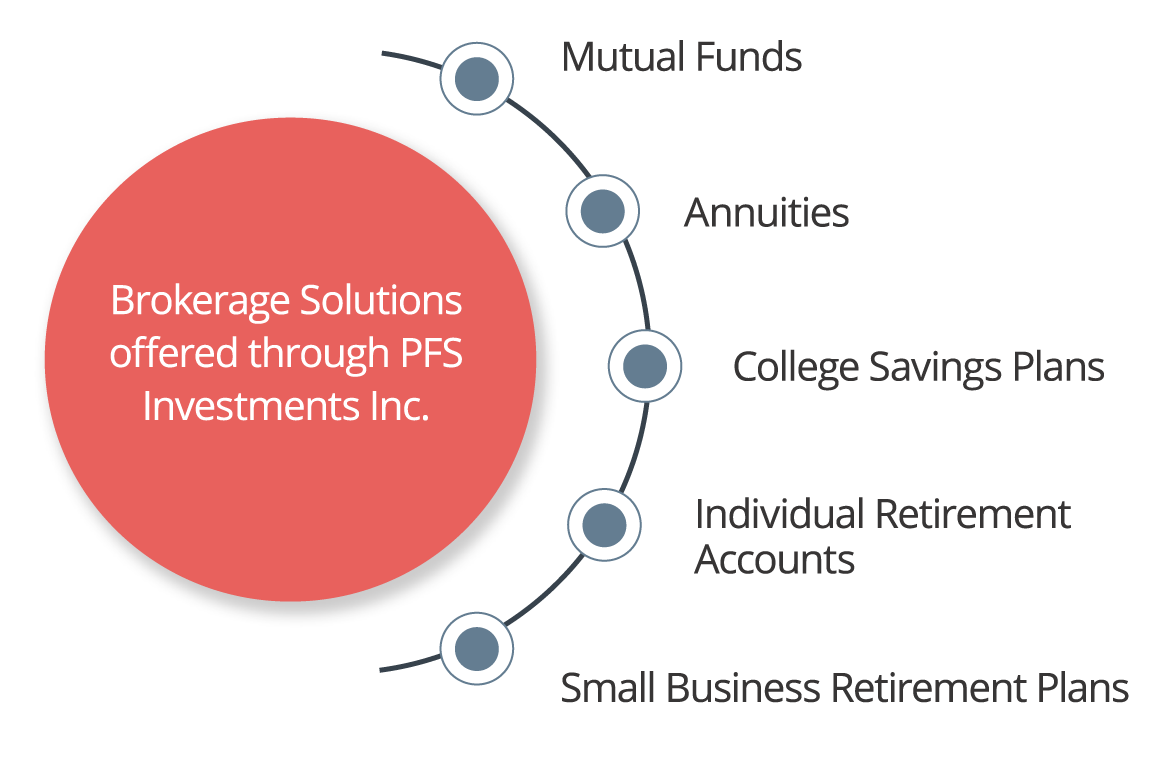

PFS Investments Inc. (PFSI) offers brokerage and advisory services. Representatives do not have investment discretion over any client account or assets. For additional information about the products and services available from PFSI, including fees, expenses and the compensation received by PFSI and your representative, please review a copy of our Form CRS, Form ADV brochure and our informational brochure, Investing with Primerica, available from your representative and online at www.primerica.com/pfsidisclosures.

PFSI, 1 Primerica Parkway, Duluth, Georgia 30099-0001, registered broker-dealer and investment adviser, member of FINRA/SIPC. PFSI offers advisory services through and is the sponsor of the Primerica Advisors Lifetime Investment Program. Primerica Brokerage Services, Inc. (PBSI), member of FINRA/SIPC, is the provider of brokerage services for the Primerica Advisors Lifetime Investment Program. Representatives who offer advisory services are supervised persons of PFSI, and are not associated persons of PBSI. Primerica, Inc., PFSI and PBSI are affiliated companies.

The Lifetime Investment Program is an advisory program sponsored by PFSI under the name Primerica Advisors. For additional information about Primerica Advisors, please ask your representative for a copy of the Lifetime Investment Program Form ADV brochure.

Mutual funds, annuities, 529 plans, 401(k) plans and asset managers referenced above are made available through contractual relationships between PFSI and the product providers.

Before investing, you should carefully consider your financial objectives, and the risks, charges, fees and expenses associated with any investments you are considering. This and other important information can be found in the prospectus and the summary prospectus, if available. Please review prospectuses, sales literature and other disclosures carefully before investing. Prospectuses are available from your Primerica representative.

Primerica representatives are not estate planners, or tax advisors. For related advice, individuals should consult an appropriately licensed professional.

This material is for informational purposes only and should not be considered investment advice or a recommendation to buy, sell or hold a security.

Investing entails risk including loss of principal. Past performance is no guarantee of future results.

Our Office:

513-484-8083

430 Ray Norrish Drive

Unit B

Springdale, OH 45246